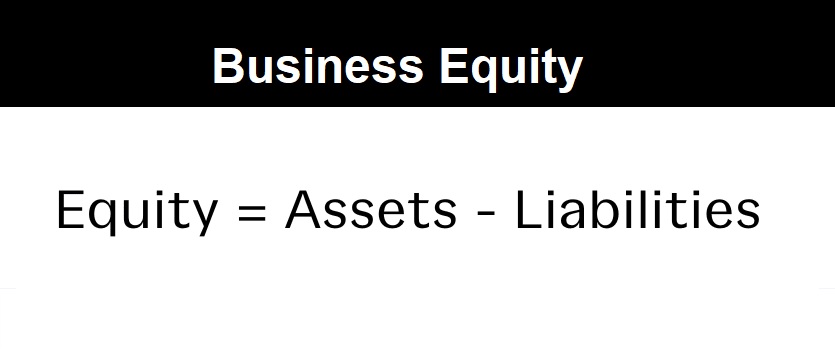

Equity in business refers to the ownership interest that shareholders hold in a company. It represents the residual claim on a company's assets after deducting its liabilities. Essentially, equity is what's left for shareholders if a company were to liquidate its assets and settle its debts. Equity can be represented in various forms, including common stock, preferred stock, and retained earnings.

Equity is vital for businesses for several reasons:

Ownership and Control: Equity represents ownership in a company, giving shareholders a stake in its operations, management, and decision-making processes. Shareholders have the right to vote on key corporate matters, such as the election of the board of directors and major strategic initiatives. This ownership structure provides shareholders with a sense of control and influence over the direction of the business.

Capital Formation: Equity serves as a crucial source of capital for businesses. When a company issues shares of stock to investors, it raises funds that can be used to finance various activities, such as research and development, expansion into new markets, acquisitions, and capital expenditures. Equity financing allows companies to grow and invest in their future without incurring debt or repayment obligations.

Risk Sharing: Equity provides a mechanism for sharing both the risks and rewards of business ownership. Shareholders assume the risk of owning equity in the company, as they may experience losses if the company performs poorly or faces financial difficulties. However, they also stand to benefit from the company's success through capital appreciation and potential dividends. This risk-sharing aspect encourages investors to invest in businesses and fosters a sense of alignment between shareholders and management.

Financial Flexibility: Equity enhances a company's financial flexibility and resilience. Unlike debt financing, which requires regular interest payments and repayment of principal, equity does not impose fixed financial obligations on the company. This flexibility allows businesses to weather economic downturns, adapt to changing market conditions, and pursue long-term growth opportunities without the burden of excessive debt.

Valuation and Investment: Equity valuation is a critical component of investment analysis and decision-making. Investors and analysts use various methods, such as discounted cash flow (DCF) analysis, price-to-earnings (P/E) ratios, and comparable company analysis, to assess the intrinsic value of a company's equity. Understanding a company's equity value helps investors make informed investment decisions and allocate capital effectively.

Employee Incentives: Equity can be used as a powerful tool for attracting and retaining talented employees. Many companies offer equity-based compensation, such as stock options, restricted stock units (RSUs), or employee stock purchase plans (ESPPs), as part of their employee incentive programs. These equity incentives align the interests of employees with those of shareholders, motivating employees to contribute to the company's success and create long-term value.

In summary, equity is a cornerstone of business finance and ownership, playing a pivotal role in capital formation, risk sharing, financial flexibility, valuation, and employee incentives. Understanding the importance of equity is essential for businesses, investors, and stakeholders alike in driving growth, creating value, and building sustainable enterprises.